December 5, 2024

On December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction against the enforcement of the Corporate Transparency […]

December 4, 2024

S Corp business owners, you can deduct the health insurance you pay for yourself and your dependents, but the IRS requires specific reporting. The amount needs […]

November 30, 2024

Summary Extending the TCJA could preserve key tax benefits for small businesses, including QBI deductions, bonus depreciation, and simplified accounting, fostering growth and stability. The Tax […]

November 18, 2024

Summary Regular bank reconciliation isn’t just a task—it’s a safeguard for your business’s financial health. By addressing discrepancies, preventing fraud, and ensuring data accuracy, you’ll be […]

November 18, 2024

Summary Year-end tax planning is essential for financial health. Maximize deductions, adjust withholdings, and leverage tax strategies to reduce liabilities and prepare for 2025. As the […]

October 31, 2024

As a current client of Ancient City Accounting, if you are not already utilizing the bookkeeping services we offer, please see the following information. We understand […]

September 18, 2024

TAX PLANNING Every year at this time, we remind you of the tax planning services we offer our clients. Tax Planning is where we analyze your […]

September 5, 2024

Believe it or not, the end of the year is quickly approaching as well as a very important deadline. A SIMPLE IRA is a great way […]

August 27, 2024

Back in February we informed you of a new filing requirement called the Beneficial Ownership Information (BOI). At that time, we advised you to hold off […]

May 29, 2024

Effective June 1, 2024, the state sales tax rate imposed under section 212.031, Florida Statutes (F.S.), on the total rent charged for renting, leasing, letting, or […]

April 18, 2024

FRIENDLY REMINDER – DON’T BE LATE… FLORIDA BUSINESS ANNUAL REPORT An annual report MUST be filed each year for your business entity (LLC, Inc or Partnership) […]

February 19, 2024

In 2021, Congress enacted the Corporate Transparency Act. This law creates beneficial ownership information (BOI) reporting requirement as part of the government of the United States […]

February 12, 2024

If you make energy improvements to your home, tax credits are available for a portion of qualifying expenses. The credit amounts and types of qualifying expenses […]

January 9, 2024

This is a reminder that once you have your December bank and credit card accounts reconciled in your online file (using the RECONCILIATION feature), please call, […]

January 5, 2024

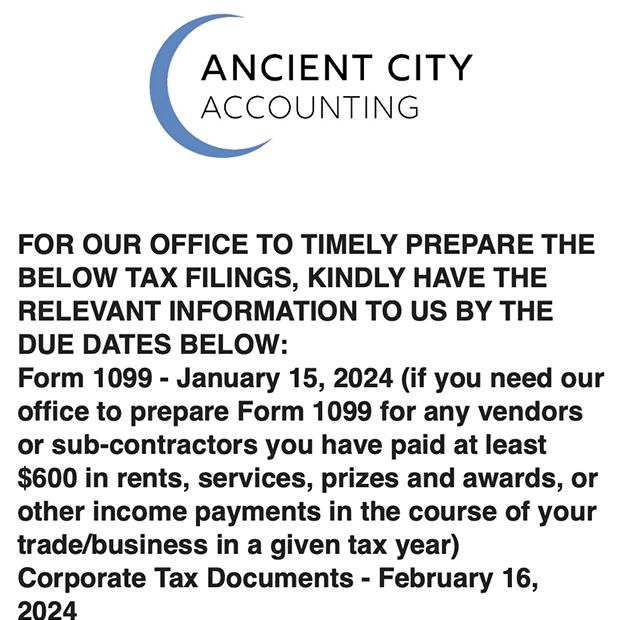

FOR OUR OFFICE TO TIMELY PREPARE THE BELOW TAX FILINGS, KINDLY HAVE THE RELEVANT INFORMATION TO US BY THE DUE DATES BELOW: Form 1099 – January […]